This might be confusing, raising anxiety and a difficult task to undertake. This means checking to see if your real net worth is the same as the application. Compared to some budgeting application, you still have to reconcile the figures. If you want a good example to tell your kids, this record could be it. This can be through your student years, your working years, as a young married couple, a young couple with kids, and middle age couple. By doing this, you have a money trail that tells others or yourself about your financial life. While chasing net worth is not healthy (life is more than about saving money and having lots of money), it does put a question in your head such as how can I improve this further?Īnd these question will ignite you to find the answers to improve. Some of you want to see how fast you can get to a particular band. You want to get your net worth to rise instead of fall. When you track your accounts in this way, you want to make the numbers better than the month before or the year before. You like to play games where you grind and get a kick out of levelling up. If you been working for 3 years, without much major aim, yet your net worth is stagnating, it might make sense to examine your expenses in detail. Tracking your finances seems to be necessary.

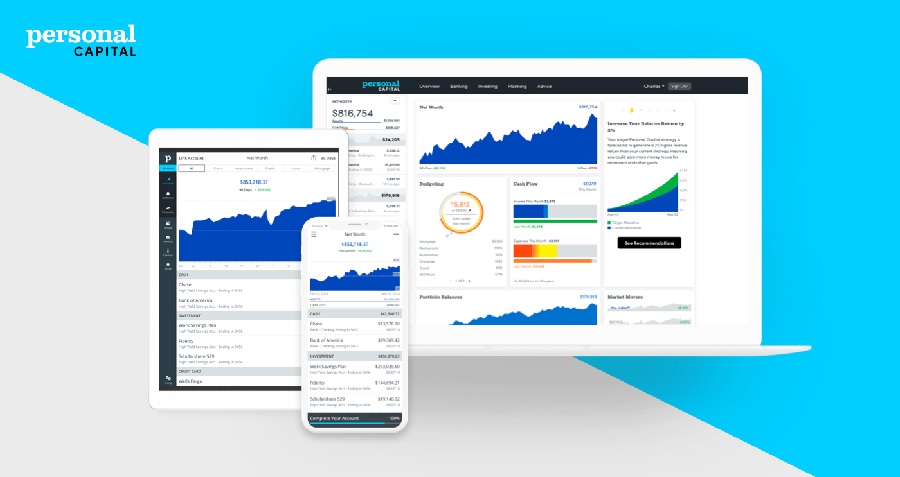

Check out the app Seedly, which helps you aggregate your bank data from DBS, OCBC, Citibank, Standard Chartered, UOB, American Express. There are even startup apps that help you aggregate your bank accounts to get the latest value. If you are not able to do this, there is nothing much anyone can help you do it. Well to take a snapshot of your accounts and net worth, you just need less than 1 hour in one month. People don’t like budgeting, tracking the expenses because they cannot form a habit of noting down how much they spend or do not have time daily (which to me is an excuse). It is less time consuming, much easier to do. One thing I regretted not collating was a snapshot of my finances on a recurring basis. I budget passively for the past 12 years. How do we do that? We track some of our asset & liability accounts or our net worth. My suggestion is not to track or budget but find out if you have a problem in the first place. We are absent-minded or are not motivated to prioritize putting the expenses somewhere.

Well, it’s not always the case.Ī lot of people fall off the budgeting bandwagon because they cannot be diligent about doing it. What most of you are anxious is whether you have a wealth problem.Īnd you think tracking your expenses or budgeting address that. The reason is that some of you might not have a big money problem in the first place. However, the general advice I tell people is, you do not need to track your expenses or budget. I believe in budgeting very much and practice it myself that I wrote an article explaining the different depths you could budget to create positive changes.

0 kommentar(er)

0 kommentar(er)